One of the key economic indicators we are keeping a keen eye on in 2017 and into 2018 is the potential return of inflation. In the USA the Trump administration has flagged anti-immigrant policies (which will likely fuel already rising wages), tax cuts and infrastructure spending each of which could add to inflationary pressures.

In the short term through 2017 the return of some inflation could be a net positive but if it is not kept in check then we believe investors will need to ensure protection in their portfolios.

We wrote the following in our January 2017 Investing Insights report:

Return of inflation?

One feature of the economic recovery since the Global Financial Crisis has been the absence of inflation (the rate at which the price of goods and services you pay for goes up). An easy way to look at inflation is to liken it to oil in an engine – you need lubrication (inflation) to make the engine (economy) run smoothly. Too little and it seizes up. Too much and it floods. You need just the right amount (typically central banks want between 2% to 3% inflation).

However, in 2017 inflation may start to return. We don’t see this as a threat (yet!) but rather as a positive in the short term if it is in the 2%-3% range. We would view this as a positive sign of an improving economy. In the USA we believe the Federal Reserve will likely tread cautiously around inflation, allowing it to tick up to promote economic growth. This will mean likely investments with a higher yield will be in demand.

The problem is inflation can be like the ill-fated Titanic – it’s really hard to turn around or stop its momentum even if you want to. If inflation goes up and keeps going up, then that could prove a huge problem for markets down the track.

Investments that can help investors protect themselves against inflation include real estate (tenant rents typically adjust upwards for inflation) and inflation linked bonds.

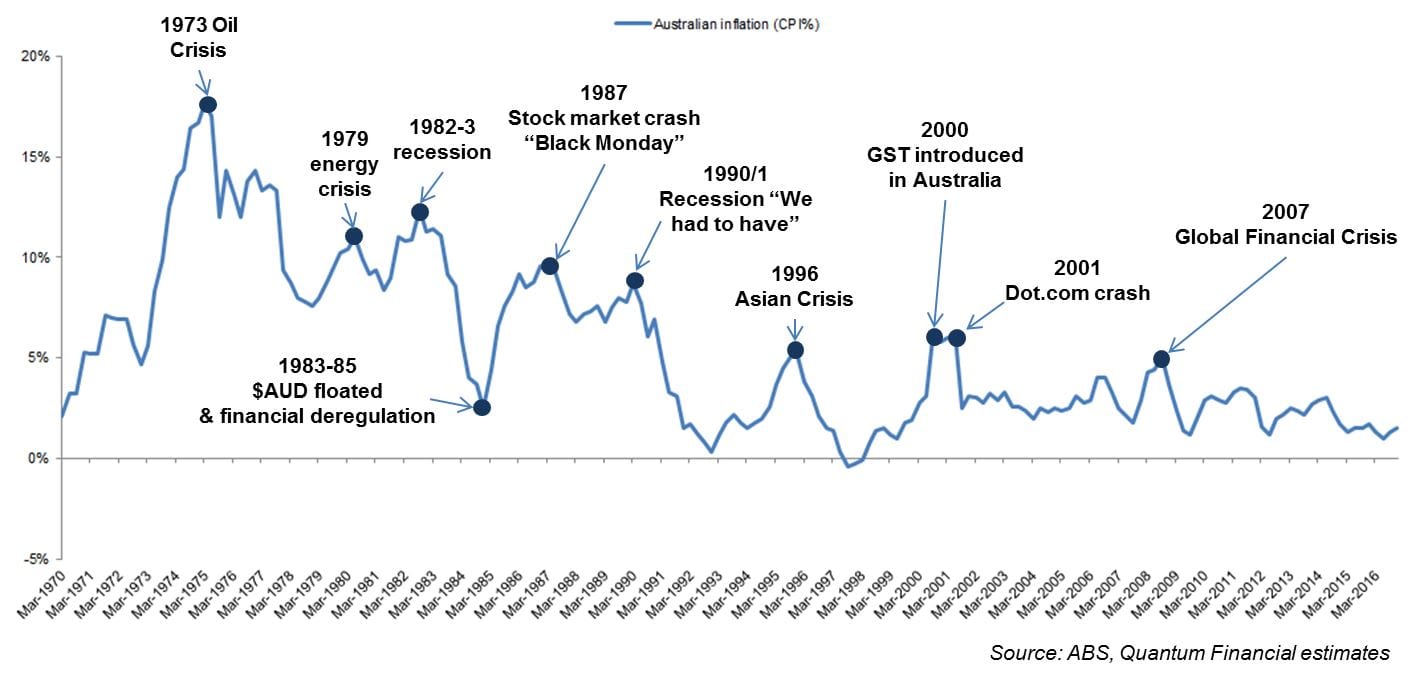

History of Australian inflation since 1970

Inflation explained

At its most simple, inflation is too much money chasing too few goods. Now you may well be thinking ‘Who doesn’t want too much money? How bad can that be?’.

As the US continues its successful program of buying bonds from financial institutions (quantitative easing or QE), inflation is a real medium to long-term risk that all investors should consider. As QE tapers (ie slows) and eventually ends in coming years, the increased supply of money may lead to inflation. Inflation reduces your investment returns and erodes your real savings. Given we can expect a delay between the implementation of QE and its economic impact, inflation could rise quickly to levels that cannot be contained.

As I’m follicly challenged, I like the way US baseballer Sam Ewing put it: “Inflation is when you pay $15 for the $10 haircut you used to get for $5 when you had hair.”

Now clearly that’s not a good thing.

You probably see it in the annual rise in private school fees, grocery bills, filling your petrol tank or paying utility bills. That’s inflation.

Not a bad thing

Just to confuse things slightly, prices constantly going up a little bit in any economy is actually a good thing. For instance, Australia’s Reserve Bank targets an average range of inflation between 2-3 per cent over the cycle. Think of this as the Goldilocks level of inflation.

Any more and we can enter into an upward spiral of inflation. Australia generally experienced inflation of 6-10 per cent through the 1970s and 1980s (peaking at 17.5 per cent during the 1970s oil shock). Any less and we can enter into a deflationary period as Japan did for two decades from the early 1990s. So some inflation is good, too much or too little is bad.

Right now we’re in Goldilocks territory but will inflation rear its head once more? In all honesty, no one really knows. The US and the world are in the middle of a giant and untested economic experiment with unknown outcomes. So far it’s working exceptionally well in the US and, to a lesser extent, in Europe, but will that success continue?

Given we don’t know, how should investors prepare for inflation? We educate our clients about inflation in terms they understand, and then factor differing inflation scenarios into their forecasts.

Younger people tend to consider inflation as a historical concept existing some time back in the pre-internet 1970s and 1980s. They have no recollection, nor experience, of inflation.

In seeking to explain the dangers of inflation to younger people, we draw upon the wisdom of Ronald Reagan. After explaining who Ronald Reagan was, we share: “Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.”

Older people have lived through periods of inflation and are more aware of inflation’s insidious ability to erode wealth by stealth. For pre-retirees and retirees, affording rising costs in retirement is typically their biggest source of anxiety, after their health and family. Rising health costs feed back as a key contributor to their rising cost of living.

Protecting your portfolio

When protecting your portfolio against the risk of inflation, assets to avoid include cash and fixed rate bonds. Both of these will lose value in a high-inflation environment.

Assets that can prove attractive include inflation-linked bonds and floating rate bonds. Their returns can ratchet up in line with inflation. Property can also be attractive as rents (yields) can be linked to or re-negotiated with inflation. If the property is leveraged with debt, owing a manageable amount of money in an inflationary period can be a good thing; it means you get to pay back a fixed debt with cheaper dollars down the track.

Equities can be a mixed bag. In the short term, an unexpected spike in inflation can lead to a fall in share values. In the medium to longer term, companies can cover their increased costs with increased prices and so it can be a good relative investment. Commodities can also be an attractive investment with inflation but this is by no means guaranteed.

We know through history we’ve had numerous inflation outbreaks and the low inflation environment we’ve had since the early 1990s is the exception, not the norm. We also know that the future for inflation won’t replicate the past. Wise investors position their portfolios for manageable risks heeding the words of Mark Twain: “History never repeats itself, but it rhymes”.

Leave A Comment